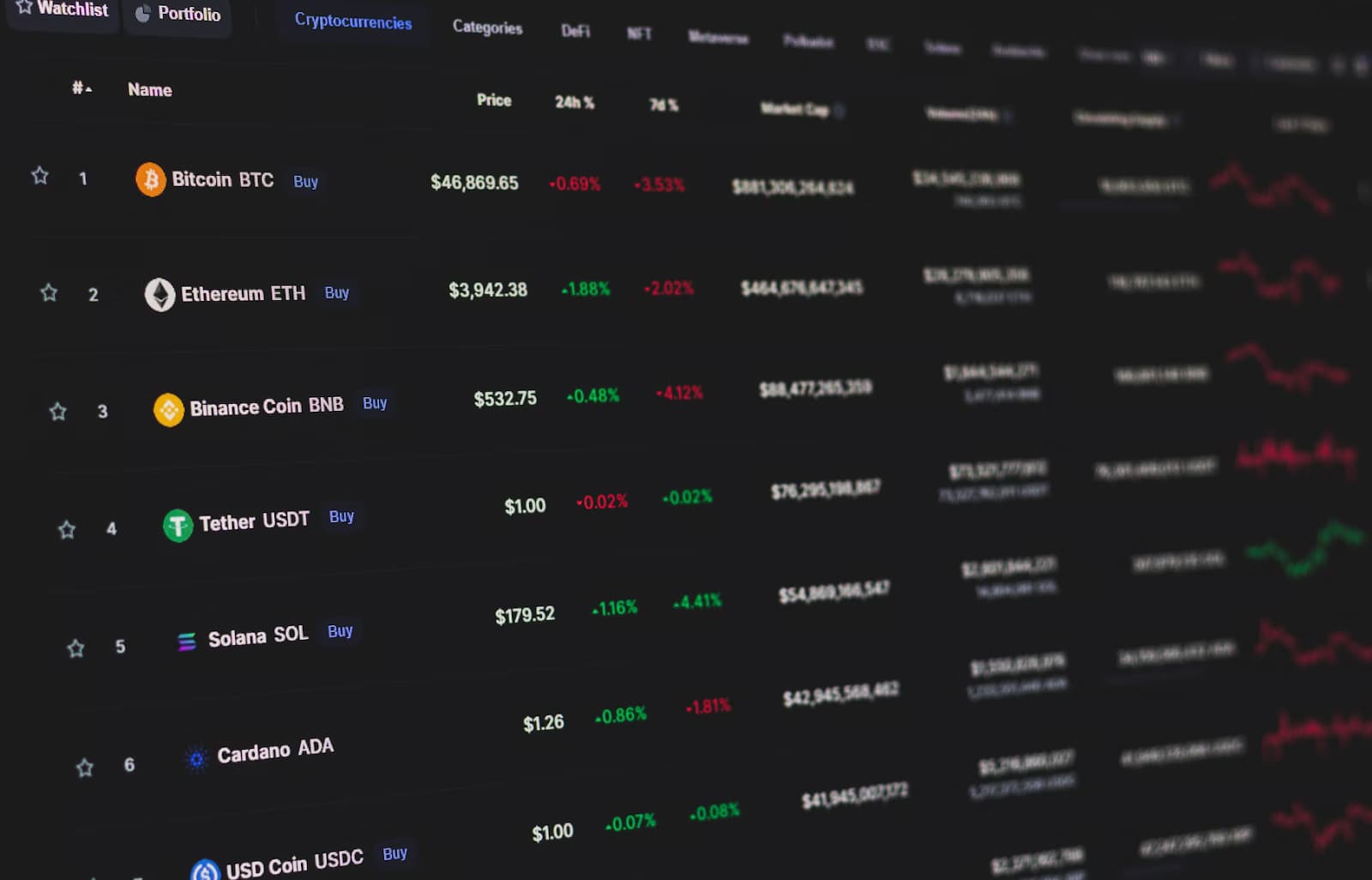

In today’s digital age, the security of online trading platforms is paramount. With millions of dollars flowing through Forex markets daily, the risk of cyberattacks, fraud, and data breaches has increased significantly. To mitigate these risks, many FX brokers are turning to innovative technologies like blockchain. Blockchain technology offers robust solutions for enhancing security, providing transparent, immutable, and decentralized records of transactions. In this article, we will explore how blockchain is improving the security measures of FX brokers, allowing traders to feel more secure in an increasingly complex and vulnerable digital environment.

What is Blockchain Technology?

Blockchain technology is a decentralized digital ledger that records transactions across a network of computers. Each block in the blockchain contains a set of transactions, and once a block is completed, it is linked to the previous one, creating an immutable chain. This structure provides several key benefits, particularly when it comes to security.

Key features of blockchain technology include:

- Decentralization: No central authority controls the blockchain, which eliminates the risk of a single point of failure.

- Transparency: Every transaction is visible to all participants in the network, providing a high level of accountability.

- Immutability: Once a transaction is recorded, it cannot be altered or deleted, reducing the risk of fraud.

- Security: Blockchain uses cryptographic methods to secure data, making it resistant to tampering and hacking.

By leveraging these features, FX brokers can enhance the security of their platforms, protecting traders from various risks associated with online transactions.

How Blockchain Enhances FX Broker Security Measures

The application of blockchain technology in the Forex industry has already begun to transform the way FX brokers secure their platforms. From transaction integrity to identity verification, blockchain provides a variety of tools that can significantly improve security. Below are the key ways in which blockchain technology is enhancing FX broker security measures.

- Secure and Transparent Transactions

One of the most significant ways blockchain enhances security is by providing secure, transparent transactions. In traditional FX trading, brokers act as intermediaries, which can introduce the risk of fraud, human error, or manipulation. Blockchain eliminates the need for intermediaries by enabling peer-to-peer transactions.- Transparent Transactions: Every transaction made on the blockchain is visible to all network participants, ensuring transparency. This prevents traders from being deceived or manipulated by hidden fees or unethical practices.

- Immutable Ledger: Once a transaction is added to the blockchain, it becomes permanent and cannot be altered or deleted. This ensures that all trade records are accurate and tamper-proof, providing a secure environment for traders.

- Transparent Transactions: Every transaction made on the blockchain is visible to all network participants, ensuring transparency. This prevents traders from being deceived or manipulated by hidden fees or unethical practices.

- Enhanced Identity Verification

Another critical security concern in FX broker platforms is identity theft. Identity fraud in online trading can lead to unauthorized access to accounts, financial losses, and other security breaches. Blockchain technology addresses this issue by offering enhanced identity verification mechanisms.- Decentralized Identity Management: Blockchain allows for the creation of decentralized digital identities, which are stored securely on the blockchain. These identities can be used to verify traders’ identities without the need for centralized databases, reducing the risk of data breaches.

- Know Your Customer (KYC): Blockchain can streamline the KYC process by securely storing and verifying traders’ identities. This helps FX brokers ensure that only authorized individuals can access their trading platforms, minimizing the risk of fraud.

- Decentralized Identity Management: Blockchain allows for the creation of decentralized digital identities, which are stored securely on the blockchain. These identities can be used to verify traders’ identities without the need for centralized databases, reducing the risk of data breaches.

- Elimination of Fraud and Chargebacks

Fraud and chargebacks are persistent issues in online trading, particularly in the context of credit card payments and withdrawals. Blockchain technology provides an effective solution by eliminating the possibility of fraudulent transactions and chargebacks.- Non-repudiation: Since blockchain transactions are immutable and verifiable, once a trade is executed, it cannot be disputed or reversed. This eliminates chargebacks, a common issue in online financial transactions.

- Smart Contracts: Blockchain-enabled smart contracts automatically execute transactions when predefined conditions are met. This reduces the risk of fraudulent actions by ensuring that both parties fulfill their obligations before a transaction is completed.

- Non-repudiation: Since blockchain transactions are immutable and verifiable, once a trade is executed, it cannot be disputed or reversed. This eliminates chargebacks, a common issue in online financial transactions.

- Secure Asset Transfers

FX brokers handle large amounts of currency transfers every day, and ensuring the safety of these transfers is essential. Blockchain technology allows for secure, instant asset transfers without the need for intermediaries.- Faster Settlements: Blockchain enables real-time settlements of trades, reducing the time it takes for traders to access their funds. This not only improves the user experience but also reduces the risk of manipulation or delays that may occur with traditional banking systems.

- Reduced Transaction Costs: By eliminating intermediaries, blockchain reduces transaction fees, making it more cost-effective for both brokers and traders.

- Faster Settlements: Blockchain enables real-time settlements of trades, reducing the time it takes for traders to access their funds. This not only improves the user experience but also reduces the risk of manipulation or delays that may occur with traditional banking systems.

- Decentralized Data Storage

Data storage is a critical aspect of any online trading platform. Traditional FX brokers store data on centralized servers, which can become targets for cyberattacks. Blockchain’s decentralized nature ensures that data is stored across a distributed network, making it more secure and less vulnerable to attacks.- Distributed Ledger Technology: Blockchain uses a distributed ledger to store data, meaning that no single point of failure exists. Even if a part of the network is compromised, the integrity of the data remains intact, as the ledger is replicated across multiple nodes.

- Data Encryption: Blockchain uses strong encryption methods to protect data, making it nearly impossible for unauthorized parties to access or alter sensitive information.

- Distributed Ledger Technology: Blockchain uses a distributed ledger to store data, meaning that no single point of failure exists. Even if a part of the network is compromised, the integrity of the data remains intact, as the ledger is replicated across multiple nodes.

- Protection Against Market Manipulation

The potential for market manipulation is a concern for all traders, but blockchain can help mitigate this risk. Blockchain’s transparency and immutability ensure that all trades are recorded in a secure, auditable ledger.- Transparent Trade History: With blockchain, every trade executed on an FX platform is recorded in an immutable ledger. This makes it easier for regulators to monitor market activity and identify potential manipulation or unethical practices.

- Audit Trails: Blockchain provides an indisputable audit trail of all transactions, allowing brokers and traders to verify trade histories and detect any irregularities in real-time.

- Transparent Trade History: With blockchain, every trade executed on an FX platform is recorded in an immutable ledger. This makes it easier for regulators to monitor market activity and identify potential manipulation or unethical practices.

The Benefits of Blockchain for FX Brokers and Traders

The integration of blockchain technology into FX brokers brings numerous benefits to both brokers and traders. These include:

- Improved Security: Blockchain’s encryption, decentralization, and immutability features make it one of the most secure technologies for online transactions.

- Faster Transactions: Blockchain’s ability to process transactions in real time reduces settlement times and ensures faster access to funds for traders.

- Lower Costs: By eliminating intermediaries, blockchain reduces transaction fees, making trading more affordable for both brokers and traders.

- Greater Transparency: Blockchain ensures that all trades are visible and auditable, improving trust between brokers and traders.

How Blockchain Can Impact Trend Trading and Other Trading Strategies

Blockchain can significantly impact trading strategies such as trend trading, where traders seek to profit from price trends. By ensuring that market data is transparent, accurate, and instantly available, blockchain enables trend traders to make better-informed decisions. Moreover, the real-time settlements provided by blockchain allow traders to execute trades faster, taking advantage of price movements as they occur.

Similarly, for traders using platforms like online MT5, integrating blockchain can streamline transactions, improve security, and enable more efficient trading strategies.

Conclusion

Blockchain technology is revolutionizing the Forex trading industry by enhancing security, transparency, and efficiency. FX brokers that incorporate blockchain into their platforms offer enhanced protection against fraud, faster transaction processing, and greater transparency for traders. As blockchain technology continues to evolve, it is likely to become a cornerstone of secure, decentralized trading platforms, benefiting both brokers and traders alike.

For further insights into the future of trading and market trends, visit reputable resources like Investopedia and FXStreet. These platforms provide valuable information for traders looking to stay ahead of the curve.